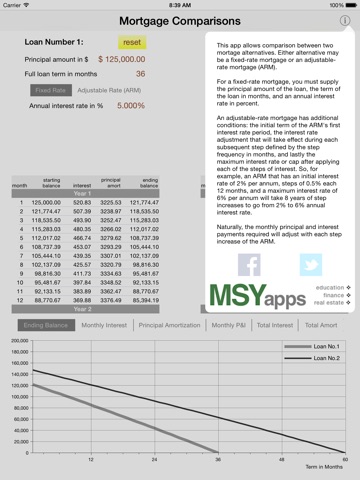

Quick Mortgage Comparisons allows comparison between two mortage alternatives. Either alternative may be a fixed-rate mortgage or an adjustable-rate mortgage (ARM).

For a fixed-rate mortgage, you must supply the principal amount of the loan, the term of the loan in months, and an annual interest rate in percent.

An adjustable-rate mortgage has additional conditions: the initial term of the ARMs first interest rate period, the interest rate adjustment that will take effect during each subsequent step defined by the step frequency in months, and lastly the maximum interest rate or cap after applying each of the steps of interest. So, for example, an ARM that has an initial interest rate of 2% per annum, steps of 0.5% each 12 months, and a maximum interest rate of 6% per annum will take 8 years of step increases to go from 2% to 6% annual interest rate.

Naturally, the monthly principal and interest payments required will adjust with each step increase of the ARM.